How To Get A Llc In Maryland

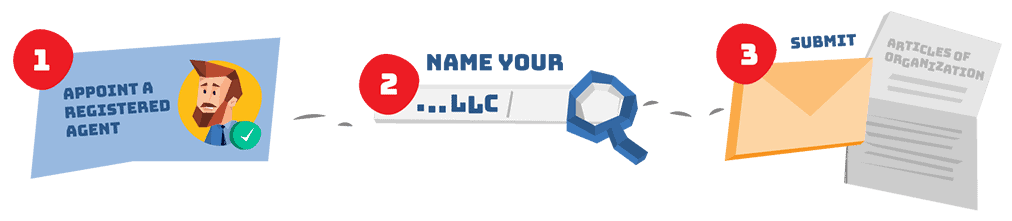

To start an LLC in Maryland, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Organization with the Department of Assessments & Taxation. You can file the document online, by mail or in person. The articles cost $100 to file ($150 expedited). Once filed with the state, this document formally creates your Maryland LLC.

1

Appoint a Registered Agent

According to Maryland Statute § 4A-210, every LLC in Maryland must appoint a resident agent (also known as a "registered agent"). You don't need to hire a resident agent, but if you do, make sure your registered agent will list their address on your articles wherever possible to ensure maximum privacy.

2

Name Your LLC

If you're starting a new business, you probably already know what you want to name your LLC. But you'll need to know if your preferred name is available. To find out, visit the Maryland Business Entity Search and search until you find the perfect name for your LLC.

3

Submit Maryland Articles of Organization

Once you know who your registered agent will be and what your LLC name is, you're ready to file your Maryland Articles of Organization. Follow along with our filing instructions below:

Learn more about each Articles of Organization requirement below. Note that the information you provide becomes part of the public record—permanently.

Or skip the form entirely and hire us to form your Maryland LLC. We provide a free business address to list whenever possible throughout the filing to better keep your personal address private. And the most affordable way to start a business? Pay just $40 out the door with our VIP monthly payment option.

1. Company Name

Your name has to include "Limited Liability Company" or an abbreviation like "LLC." You can't use a name that's the same or too similar to a name already in use in the state.

2. Purpose

While the purpose of most businesses is to make a profit, don't write that in your articles. "Purpose" here is really asking what your LLC's business activities are. Most businesses keep it really general with a statement like "the purpose of this LLC is to engage in any lawful activity in the state of Maryland."

3. Principal Office

You have to list a street address in Maryland (no PO Boxes). Rather not list your personal home or office address on this public filing? When you hire Northwest, you can keep better maintain privacy and list our address here.

4. Resident Agent and Address

For your Maryland registered agent, you can appoint an adult state resident (such as yourself) or a service (like Northwest). You'll also need to list the street address in Maryland where your resident agent will be available during business hours. Hire Northwest and our address will go here. For paper filings, your registered agent will also need to sign your articles.

5. Maryland LLC Authorized Person

Your authorized person is just the person your LLC authorizes to sign and submit the Articles of Organization. It doesn't have to be anyone in the LLC. Northwest will be your authorized person when you hire us.

Professionals in Maryland hire registered agent services like Northwest Registered Agent to start an LLC—but why?

Logistics

Standard filing companies don't have employees or offices in every state. But as a national registered agent, it's a requirement for us, which is a benefit for our clients. Our office is in Oakland, MD. We're on a first name basis with the people who work in the Department of Assessments & Taxation. We know all the fastest filing methods, which translates to fast, professional service—without extra fees.

Privacy

As your registered agent, we list our Oakland registered office address on your LLC's formation documents. Why? If you're starting a business from your apartment in Baltimore, do you really want your apartment address as your business address? (Hint: the answer is no.) We'll list our address, so you don't have to list yours. Plus, we never sell your data. We don't list your personal information on filings if we don't have to. It's all standard and part of our commitment to Privacy by Default®.

Free Mail Forwarding, Business Address and More

At Northwest, we do everything a registered agent should do and more. You can list our address as your business address on your state filings. We include limited digital mail forwarding with registered agent service (up to 5 pieces of regular mail per year; $15 a doc after that).

Plan on accepting credit cards? We also offer a Free Credit Card Processing Consultation. Our specialists work with processors to negotiate low rates and better contracts for our clients.

And now, try our in-house Northwest Phone Service for 60 days, free of charge with our formation service. Get a virtual phone number with your choice of area code, make and receive calls from any device, and more—for just $9 a month.

Local Expertise

We know the in's and out's of each state—and we use this knowledge to help you when you need it most. Our team of Corporate Guides® has over 200 local business experts. You can call or email us for answers to all your questions about your LLC in Maryland.

Do It Yourself

Sign up for a free account and use our online tools to start your Maryland LLC today. Includes Maryland LLC formation and maintenance walkthrough and company document creation. All for free—just pay state fees.

$ 0 Total

Go Monthly

Skip the state fees! Get a Maryland LLC and the best of our services today. Includes EIN, hassle-free maintenance, business address & mail forwarding, Privacy by Default®, local Corporate Guide® service, and everything you need to operate at full capacity.

$ 40 / Month

Pay in Full

Includes Maryland LLC, business address & free mail forwarding, free 60-day Phone Service trial, Privacy by Default®, lifetime support from local Corporate Guides® and a year of registered agent service.

$ 380 Total

Rated 4.5 / 5 stars by 254 clients on Google

After your Maryland Articles of Organization are approved, you still have a few more important steps to take, including getting an EIN, drafting an operating agreement, opening a bank account, funding the LLC and learning about state reporting and tax requirements.

Get an EIN

An EIN ("Employer Identification Number") is a federal tax ID assigned to your business by the IRS. The IRS uses your EIN to easily identify your business on tax filings.

Does a Maryland LLC need an EIN?

On the federal level, your LLC is required to get an EIN if you have employees or file certain federal excise taxes (like Alcohol/Tobacco/Firearms returns). There are also plenty of local reasons you'll need an EIN. When you go the bank to open an account or take on debt, they'll ask for your EIN. When you go to establish credit with a vendor, they'll likely ask for your EIN. In some cases, you can give your personal social security number instead, but with the rise of identity theft and data mismanagement, who wants to do that?

How do I get an EIN for my LLC?

You can apply for an EIN directly from the IRS at no cost. Most businesses are able to apply online, but if you don't have a social security number, you'll need to apply with a paper form. Want one less thing to do? Add on EIN service when you hire us, and we'll get your EIN for you. Or choose our VIP service—an EIN is included.

Write an LLC Operating Agreement

Operating agreements put into writing how your business actually operates—how much each member invested, how profits and losses will be allocated, how voting works, and what happens if there's a dispute or if the whole business (knock on wood) falls apart.

For more on Maryland operating agreements (including free Maryland operating agreement templates), see our Maryland LLC Operating Agreement resource.

Do I need an operating agreement for a Maryland LLC?

Maryland doesn't legally require an operating agreement. According to Maryland Law §4A-402, members may enter into an operating agreement, but the law doesn't specifically require companies to have a written agreement.

That said, an operating agreement isn't just annoying paperwork. It's one of your LLC's most important internal documents, and creating one can help your LLC with everything from opening a bank account to handling major events from mergers to dissolution.

What should be in an operating agreement?

An operating agreement should explain how the business will handle "big picture" situations—everything from allocating profits and losses to dissolving the business. Below is a list of common topics that operating agreements should cover.

-

Initial investments

-

Profits, losses, and distributions

-

Voting rights, decision-making powers, and management

-

Transfer of membership interest

-

Dissolving the business

Your operating agreement can cover pretty much anything as long as it isn't contrary to Maryland law. Maryland Statute § 4A-402 goes over provisions that can be made in the operating agreement, such as quorum requirements and procedures for waiving meetings.

How do I write an operating agreement?

To write an operating agreement, you need to address how your business will handle money, members, votes, management, and more. Not sure how to get started? At Northwest, we're here to help your LLC get off on the right foot. When you hire us, we provide your business with a free LLC operating agreement, specific to your management style. We've spent years developing these agreements and other free LLC forms—which have been used by over a million LLCs.

Open an LLC Bank Account

Your LLC needs its own bank account. Why? An LLC gets its limited liability from being a distinct entity, separate from its members. If you mix personal and business finances, you could lose your liability protections.

How do I open a bank account for my Maryland LLC?

To open a bank account for your Maryland LLC, you will need to bring the following with you to the bank:

-

A copy of the Maryland LLC Articles of Organization

-

The LLC operating agreement

-

The LLC's EIN

If there are multiple members in the LLC, you may also want to bring an LLC resolution to open a bank account that states that the person going to the bank is authorized by the members to open the account in the name of the LLC. Northwest can help with this as well—LLC bank resolutions are one of the many free legal forms we provide to ensure you can get your LLC started fast.

Fund the LLC

Time to put some money in that new LLC bank account. What money? For starters, your initial contributions to your LLC's capital. LLC members are owners, and each owner needs to pay for their membership interest to fund the LLC.

What is membership interest?

Membership interest is your percentage of ownership of the LLC. Membership interest is normally proportionate to your investment. So how does this work?

Imagine your LLC has 5 members. 4 members each invest $1,000 in the business. One member invests $6,000. The total contribution of all members is $10,000. The 4 members each own 10% of the business. The moneybags member who shelled out $6,000 owns 60% of the business.

Typically, this also means that the 4 members would each get 10% of any profits, and moneybags would get 60%. Exactly how profits and losses are allocated, however, can be adjusted in the operating agreement as long as changes are in line with IRS requirements and Maryland laws.

File Maryland Reports & Taxes

Every year, Maryland LLCs are required to file a Maryland Annual Report and typically a Personal Property Return as well. Maryland LLCs are also subject to state tax filing requirements.

What is a Maryland LLC Annual Report?

A major hit to your wallet. Every year, you're required to fork over $300 to file a Maryland LLC Annual Report by April 15th. The report updates the state on your LLC's ownership and contact information. Maryland also requires businesses with personal property in the state to file a Personal Property Return (described below) along with the report.

When you sign up for Northwest, we send you reminders for your annual report due dates. Want one less thing to worry about? With our business renewal service, we can complete and submit your annual report for you for $100 plus the state fee. (If you're required to file the personal property tax return, we'll send you the completed annual report for you to add your tax information. Then, we'll submit your report for you).

What is a Maryland LLC Personal Property Return (PPR)?

The PPR is a tax return where you report the value of your personal property. You have to submit a PPR together with your Annual Report each year if you have a Trader's License or if your LLC owns, lease or uses personal property in Maryland.

Personal property doesn't include intellectual property, real estate, registered vehicles or land—but it does include pretty much everything else. Furniture, computers, books, supplies, tools—even inventory. Even the curtains in your office (no joke). The form takes some work, so give yourself plenty of time to go over it before April 15th when it's due. Your total personal property tax will be determined by the assessed value of your business's property multiplied by the tax rate for the county in which the property is located.

What should I know about Maryland LLC taxes?

Maryland has a progressive personal net income tax. For singles filers rates, are:

2%: $0 to $999

3%: $1,000 to $1,999

4%: $2,000 to $2,999

4.75%: $3,000 to $99,999

5%: $100,000 to $124,999

5.25%: $125,000 to $149,999

5.5%: $150,000 to $249,999

5.75%: $250,000+

If your LLC has nonresident members, you may have to pay some entity-level income tax as well. To recover the tax money lost to nonresidents (who file personal returns in their home states), Maryland requires pass-through entities with nonresident members to essentially make up the difference by filing Form 510C.

The state sales tax in Maryland is 6%—cities and counties can't tack on local sales tax either. There are a few exceptions to the 6% rule though. Alcoholic beverages are taxed at a 9% rate, and most short-term vehicle rentals are taxed at an 11.5% rate.

How can I submit the Maryland LLC Articles of Organization?

You can file Maryland articles online, by mail or in person. Online filings can be made via Maryland Business Express. Paper filings are submitted following address:

Department of Assessments and Taxation

301 W. Preston Street

Baltimore, MD 21201-2392

How much does it cost to start a Maryland LLC?

The filing fee for Maryland LLC Articles of Organization is $100. Expediting (recommended) is another $50. If filing online, there's also a credit card processing fee of 3%.

Hire Northwest for a one-time fee of $380 expdited, including state filing fees, a year of registered agent service, limited mail forwarding and loads of useful forms and tools to help get your Maryland LLC up and running. Or, pay just $40 out the door with our VIP monthly payment option.

How long does it take to start a Maryland LLC?

Maryland LLC filing times vary depending on your filing method. Without expediting, filings can take upwards of 6 weeks. Expedited filings (+$50) are processed in a much more reasonable time period—typically in under 2 weeks.

If you hire Northwest to start your LLC, we file online and typically have your expedited Maryland LLC formed within 10 business days.

Does a Maryland LLC need a business license?

Not on the state level—but you may need a local business license. For example, Ocean City requires all businesses operating in the city to get a license. Contacting the city and county offices where you plan to do business is a good way to find out exactly what you'll need.

Need an EIN or a certified copy of your formation docs for your license applications? Northwest can help. You can easily add on these items to your LLC formation order.

Can a Maryland LLC help me live more privately?

Yes. While you can't remove all ownership information from Maryland public filings (like you can in states like New Mexico, Delaware, and Wyoming), a Maryland LLC can still help you reduce your public footprint. For instance, you can maintain better address privacy by listing our address on public docs instead of your own. Check out our page on living privately with an LLC to learn more.

What is a foreign Maryland LLC?

A foreign Maryland LLC is any LLC formed outside of Maryland but registered to do business in the state. For example, if you formed an LLC in Pennsylvania but wanted to conduct business in Maryland as well, you would register as a foreign LLC in Maryland by filing a Foreign Limited Liability Company Registration with the Maryland Department of Assessments & Taxation. Like domestic LLCs, foreign LLCs in the state have to file annual Maryland annual reports. Northwest can register your foreign Maryland LLC for you today!

How can I get a Maryland phone number for my LLC?

It's a conundrum: you need a local number to display on your website and give to customers, but you don't want to make your personal number quite so…public. We get it. And we've got you covered with Northwest Phone Service. We can provide you with a virtual phone number in any state—plus unlimited call forwarding and tons of easy-to-use features. You can try Phone Service free for 60 days when you hire us to form your LLC, and maintaining service is just $9 monthly after that. No contract required.

Our Maryland LLC formation service is designed to be fast and easy—signing up takes just a couple minutes. Here's how it works:

1

Signup

With Northwest, we give you flexibility on how to pay. You can pay all the fees up front (this includes one full year of registered agent service). Or, pay just $40 out the door with our VIP monthly payment option. With our VIP option, we also include an EIN. Just choose one of the buttons below, answer a few easy questions about your business and submit your payment.

2

State Approval

We'll prepare your Maryland Articles of Organization and send them to the Department of Assessments & Taxation for approval. In the meantime, you'll have immediate access to your online account, where you can find useful state forms, pre-populated with your business information.

3

Your Maryland LLC!

Once the Maryland D epartment of Assessments & Taxation has approved your filing, we notify you that your Maryland LLC has been legally formed. You can now take any necessary next steps, like getting an EIN and opening a bank account.

How To Get A Llc In Maryland

Source: https://www.northwestregisteredagent.com/llc/maryland

Posted by: quadetherreemed.blogspot.com

0 Response to "How To Get A Llc In Maryland"

Post a Comment